Adaptation pathways

To develop effective flood risk reduction

strategies that can adapt to changing

circumstances, planning approaches that

incorporate adaptability and flexibility are

essential. To accommodate flexibility into

decision-making and account for the evolving

nature of flood risk, the application of

“adaptation pathways” has been identified

as a promising approach. Adaptive pathway

planning enables decision-making over time,

in response to how the future unfolds.

The dynamic adaptive policy pathways

(DAPP) method is a method in which adaptive

pathways are used to develop plans that are

subject to uncertainty (Haasnoot et al., 2013).

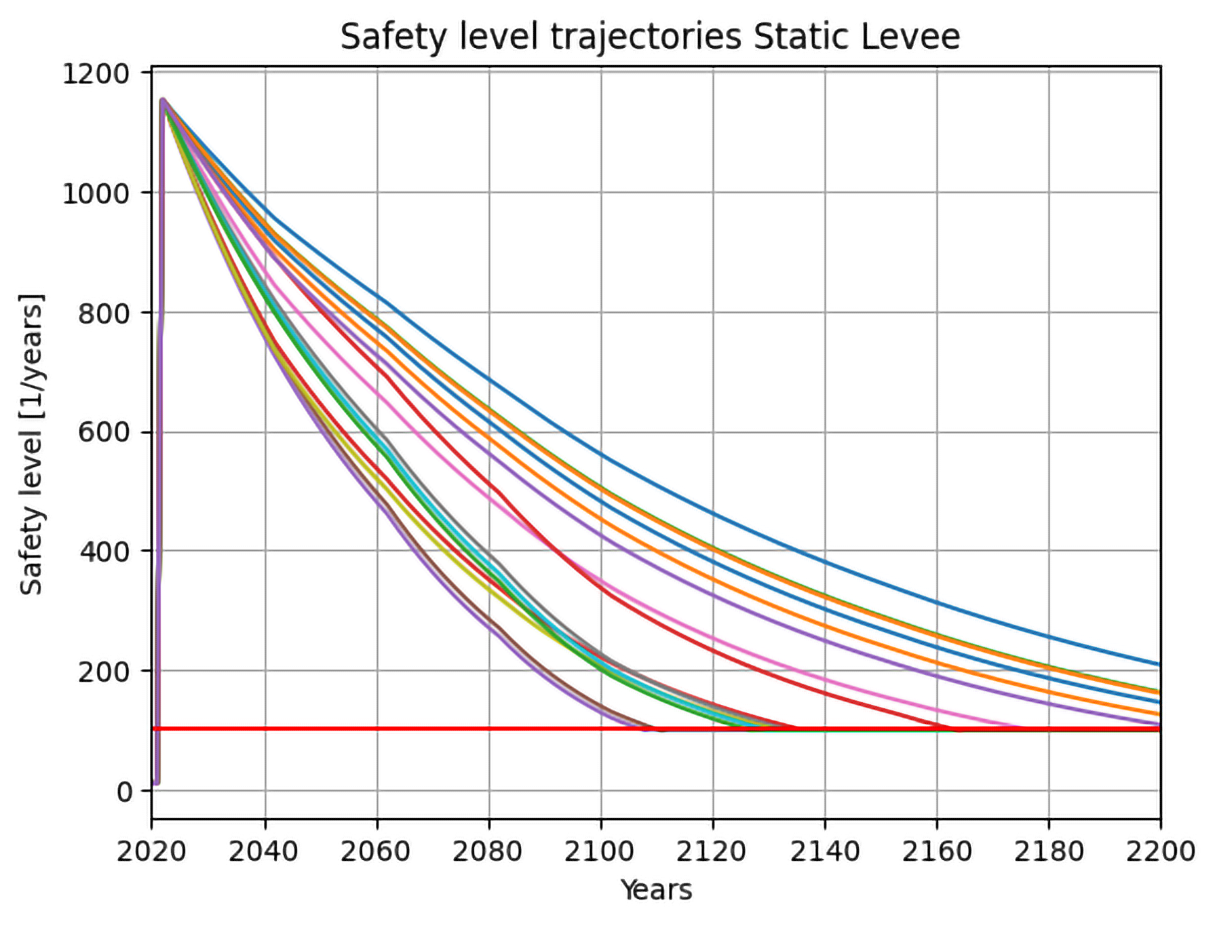

Figure 1 shows a schematic overview

of a pathway map, a feature of the DAPP

approach. It shows the available actions and

the different pathways that can be chosen.

The methodology is based on the idea that

investment choices (or actions) have a finite

lifespan and may no longer meet goals if

circumstances change, i.e., when a threshold is

crossed, known as the adaptation tipping point

(ATP) (Kwadijk et al., 2010).

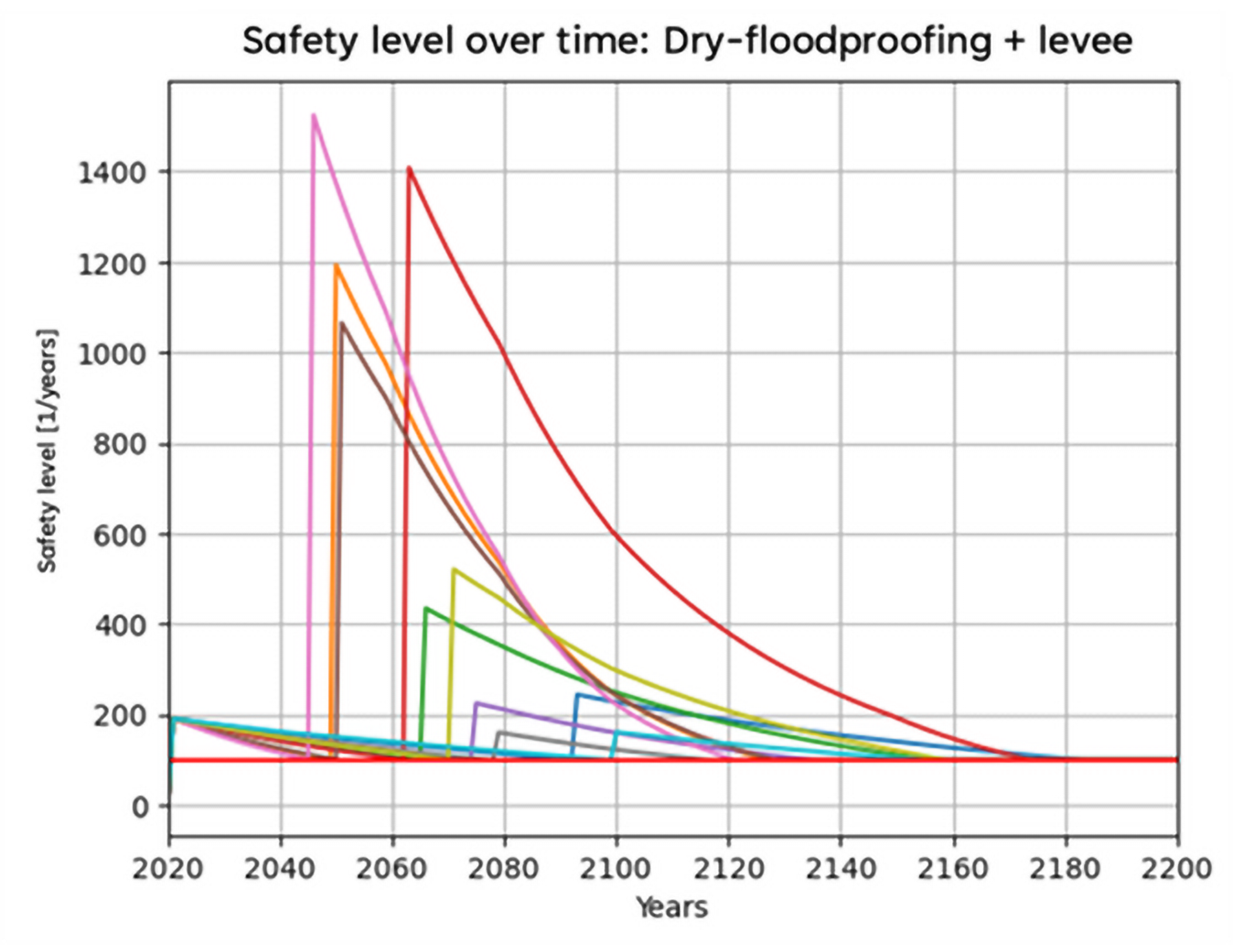

In a flood risk reduction strategy, for example,

sea level rise can result in a minimum safety

level no longer being met. When an action

no longer fulfils the objective, new actions

are required to meet the standards again,

leading to a variety of alternate pathways.

The trade-offs between their costs and

benefits will determine which pathways are

preferred over others. If there is only one initial

decision moment, the strategy is considered

static. However, if there are opportunities to

make decisions based on available knowledge

at different points in the design process,

the strategy is flexible or adaptive.

While adaptive planning offers advantages,

it also presents challenges and weaknesses

compared to static approaches. Some

challenges include uncertainty in future

developments, potential trade-offs between

short-term and long-term objectives,

and the need for continuous monitoring

and adjustment. In contrast, static

approaches provide a more straightforward

and predictable framework but may lack the

ability to respond effectively to changing

circumstances. To discover which strategy is

optimal for a project location, adequate and

thorough evaluation is necessary.

Economic evaluation

Various methods exist for economically

evaluating adaptive strategies, including

cost-benefit analysis (CBA), real option

analysis (ROA) and robust decision making

(RDM). Multiple flood risk evaluation methods

have been evaluated and it was found that

each method comes with its own strengths

and limitations. The premise of adaptive

pathway planning is the ability to re-evaluate

and reassess taken or possible new actions.

Currently, no method is found to evaluate

strategies under uncertain conditions and

include the premise adaptation pathways.

Research objective

This research focussed on filling these

identified gaps and contributing to enhancing

the economic evaluation of adaptive pathways.

Without an adequate evaluation method,

validating positive expectations about

adaptive pathway planning remains

challenging. The study was divided into

three subtopics:

- Evaluation of current evaluation methods.

- Investigate the value of time

- Test new evaluation method.

Creating a new method

Analysis of evaluation methods

Multiple approaches exit to develop and

evaluate flood risk reduction strategies.

Certain methods focus on the uncertainty,

other focus more on incorporating flexibility.

For this study, the most used techniques

were evaluated to derive its strengths and

weaknesses. Based on the found results a

new method could be formulated.

Robust decision making (RDM)

RDM aims to create decision strategies that

are robust and perform well under diverse

future scenarios. It emphasises evaluating

various options, including worst-case

scenarios, to identify robust strategies.

Robust refers to the ability to perform well

even under conditions of high uncertainty or

ambiguity. Identifying strategies that are

robust helps decision-makers minimise the

risk of negative outcomes and increase the

resilience of their systems. Additionally, RDM

aims to increase transparency by taking into

account various objectives and criteria in the

decision-making process.

RDM has the ability to facilitate so called

“deliberation with analysis” (Groves et al.,

2019). This term describes the process of

decision-making where people or groups

carefully and methodically consider options

and potential outcomes before reaching a final

conclusion. It involves careful consideration of

relevant information, weighing of alternative

options and evaluation of the potential

consequences of each decision. This approach

is often used in complex situations where there

are multiple factors to be considered and

where the stakes are high.

Real option analysis (ROA)

ROA, rooted in financial option theory,

captures and values flexibility in decision-

making. It introduces the concept of real

options, allowing for changes in investments

based on new information. ROA categorises

options as “on” or “in” a system, offering

valuable insights for climate adaptation

plans. An example of a real option “on”

a system is the option to defer or abandon a

project. On the other hand, real options “in” a

system are options that are incorporated into

the design of the system. For example, making

allowance for future expansion of a levee by

over designing the foundations.

Both options “in” as options “on" a system are

valuable for climate adaptation plans. So, in

contrast with the traditional planning approach

in which only one-off investment options are

recognised, the real option’s concept is able to

take management flexibility and volatility into

account by enabling changes to an investment,

in case new information becomes available in

the future (Buurman and Babovic, 2016).

In a traditional CBA, uncertainty is included by

expected values depending on probability

distributions. The downside of this approach is

that it connects a “now or never” quality to the

decision moment. This quality is only suitable in

case there is no flexibility. However, when the

possibility exists to modify the decision, a

traditional CBA tend to undervalue. With ROA,

at every moment, the option to invest or not to

invest is evaluated. The value of options of

taking measures later or now is valued.

The ability to choose a different course of

action or to decide to postpone an action until

more information is available, results in the

opportunity to limit the negative effects of

making a poor choice while also maximising

the positive effects of the newly available

information. This aspect is the main premise of

the adaptive planning concept. However, the

downside of ROA is that it is complex to

perform as many uncertainties need to be

quantified, integrated and discretised in

scenarios, as showed by Kind et al. (2018).

Extended cost-benefit analysis (CBA)

The study of de Ruig (2020) and Haasnoot

et al. (2020) extended the traditional CBA

framework to evaluate adaptation pathways.

They both extended the time horizon of the

traditional CBA and included evaluation of

sequential measures. De Ruig’s method

(2020) incorporates both the temporal

and spatial dimensions of climate change

impacts and evaluates a range of adaptation

measures and their timing to identify the

most cost-effective and efficient pathway.

Similarly, Haasnoot et al. (2020) extended the

traditional CBA framework by incorporating

multiple scenarios and an extended time

horizon to evaluate sequences of investments

or adaptation options. The most effective

pathway is determined by the climate and

socio-economic scenario that is considered.

Transfer costs are included that quantify the

path-dependency of options.

Both methods build on the traditional CBA

framework and provide a more thorough

analysis by taking into account a range of

factors and considering the long-term effects

of climate change. The recommendation that

followed from this research is to incorporate

the flexibility in the economic assessment that

would enable alterations in the type and/or

height of subsequent measures for conditions

different from assumed.

Reduced uncertainty: the value of time

A flood risk reduction strategy is subject

to various uncertainties which makes it

difficult to design the optimal strategy.

The performance of the strategy could be

increased in case there is a possibility to

base decisions on new and more accurate

information. The “updated” knowledge which

could lead to reduced uncertainty is one of the

possible drivers of the added value of adaptive

pathway planning.